Your cart is currently empty!

Tag: insurance

How to Get a State Employment Insurance Number in Delaware

Starting a business in Delaware can be exciting, but there are a few important steps to take care of before hiring employees. One of those is applying for a State Employment Insurance Number. This number is issued by Delaware’s Division of Unemployment Insurance and is required for all employers who pay wages in the state.

In this guide, you’ll find everything you need to know about getting your Employment Insurance Number—based on my own experience setting up a business in Delaware.

What Is a State Employment Insurance Number?

A State Employment Insurance Number is used by the state to track unemployment insurance tax contributions. This number is separate from your federal EIN (Employer Identification Number) and is required by Delaware law if you plan to have employees.

Delaware uses this number to make sure that your business is contributing to the unemployment insurance fund. That fund, in turn, supports workers who may lose their jobs in the future. It’s all part of staying compliant with state employment laws.

Who Needs This Number?

Any business with employees in Delaware needs to apply for a State Employment Insurance Number. Even if you only hire part-time help or seasonal workers, you’re still required to register with the Division of Unemployment Insurance.

When I hired my first part-time assistant, I didn’t think this rule applied to me—but it absolutely did. Whether you’re operating a brick-and-mortar shop or working from a home office, if you’re paying wages, you must register.

If you’re looking into other important coverages, check out why business insurance is necessary for Delaware-based employers.

What You’ll Need Before You Apply

Getting prepared ahead of time made the application much smoother for me. Here’s what Delaware typically requires before you can register:

- Business Name and Address – Your official business details as registered with the state

- Federal Employer Identification Number (EIN) – Assigned by the IRS

- Delaware Business License – If you haven’t applied yet, this is a separate step

- SSN or ITIN – For sole proprietors or individuals without a business EIN

If you’re still waiting on your EIN, our guide on how to get an EIN can help you complete that step first.

How to Apply for a State Employment Insurance Number in Delaware

Prepare Your Business Information

Before visiting the registration portal, make sure you have all your documentation ready. Double-check business name spellings, your address, and EIN. Small errors can delay your application.

Register Through Delaware’s Department of Labor

Delaware’s Division of Unemployment Insurance provides both online and in-person options. I chose the online application, which saved a lot of time. You can access the portal through the official Delaware Department of Labor website.

Navigate to the Unemployment Insurance section and look for the Employer Registration page to get started.

Complete and Submit the Application

Fill out the form carefully. It will ask for your business structure, type of services, start date, and expected wages. Once complete, submit it either online or print it out for in-person submission.

If you’re offering any transportation or delivery services as part of your business, it might also be time to think about commercial auto insurance to stay fully protected.

What Happens After You Apply?

Once your application is submitted, Delaware usually takes a few days to process it. In my case, I received my Employment Insurance Number in about a week. Keep an eye on your inbox or mailbox for confirmation.

Once you have it, you’ll start using the number to report unemployment tax payments and file required forms. It’s a critical ID for your payroll system.

Common Mistakes to Avoid

Applying is simple, but it’s also easy to make small mistakes that can cause delays. From my experience, here’s what to watch for:

- Incomplete Applications – Always check that all fields are filled in

- Wrong EIN or Business Info – Errors here can slow down approval

- Not Following Up – If it’s been over a week, contact the Department of Labor to check status

To stay ahead of other compliance issues, check out MyWebInsurance.com renters insurance if you’re running your business from a rented office or property.

Why It Matters

Having a State Employment Insurance Number isn’t just a formality—it’s a requirement. It keeps your business compliant, helps your employees qualify for unemployment benefits, and protects you from penalties.

It’s also something you’ll need for tax filing, payroll setup, and potentially when applying for certain licenses or loans.

Final Thoughts

Getting a State Employment Insurance Number in Delaware was easier than I expected once I knew what was required. It’s one of those steps that shows you’re serious about running your business the right way.

For anyone planning to hire employees, don’t put this off. The application only takes a short time, and the benefits of being compliant from the start far outweigh the consequences of skipping it.

If you’re new to Delaware business ownership, you might also want to check out our guide on liability insurance to keep your business covered from the start.

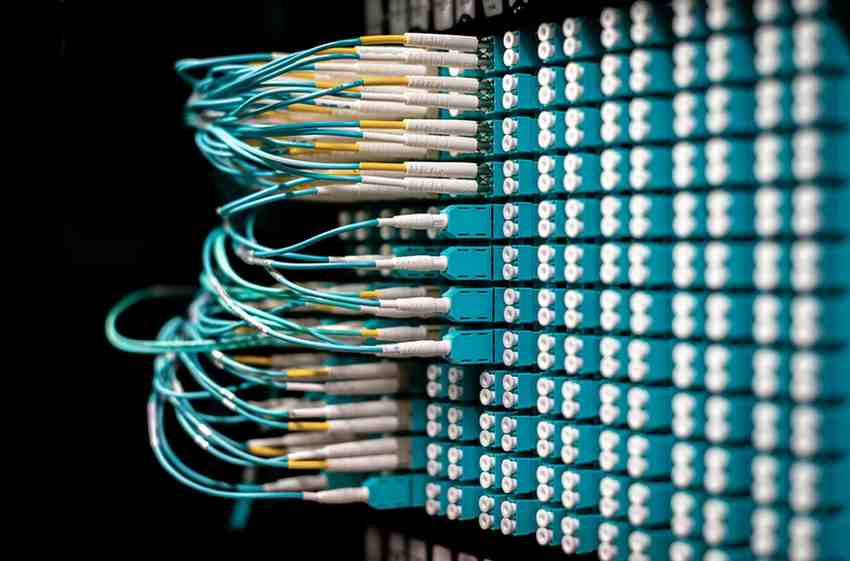

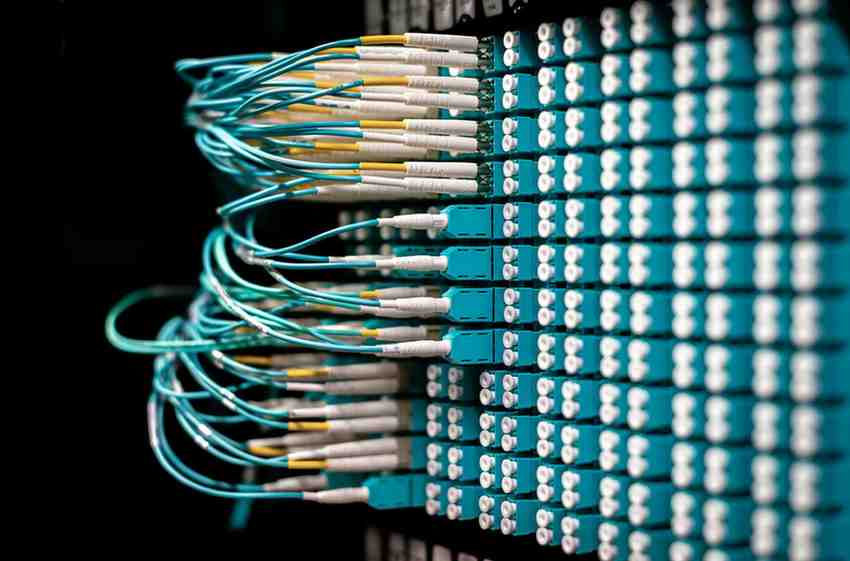

How to Start a Fiber Optic Business

The fiber optic industry is experiencing rapid growth, driven by the increasing demand for high-speed internet and advanced communication technologies. Starting a fiber optic business can be a lucrative venture, especially for those who are tech-savvy and ready to navigate a complex but rewarding market. This guide will walk you through the essential steps of launching your own fiber optic business, from market research to customer satisfaction, as well as important considerations like business insurance for fiber optic cable services.

Conduct In-Depth Market Research

The foundation of any successful business is thorough research, and the fiber optic sector is no different. Start by investigating the demand for fiber optic services in your target area. Determine whether there is a market gap for faster, more reliable internet connectivity, especially for sectors such as businesses, educational institutions, healthcare facilities, and government agencies.

Section Title Description Introduction Overview of the fiber optic industry’s growth and opportunity. Understanding the Fiber Optic Industry Key types of fiber optic cables and their applications. Steps to Start a Fiber Optic Business Market research, business planning, and necessary permits. Building Your Team Hiring skilled technicians and partnering with suppliers. Marketing and Growth Effective marketing strategies and client relationships. A comprehensive market analysis will help you:

- Identify your target audience (residential, commercial, or both)

- Understand the services offered by existing competitors

- Spot untapped opportunities or underserved areas

- Build a competitive advantage for your business

By knowing where the demand lies and what the competition is offering, you can better define your business’s unique selling proposition (USP) and shape your service offerings to cater to specific customer needs.

Define Your Fiber Optic Services

Once you’ve identified a viable market opportunity, it’s crucial to clearly define the range of services your fiber optic business will provide. Fiber optic infrastructure typically includes a range of services such as:

- Installation: Setting up the fiber optic cables and necessary hardware.

- Maintenance: Ensuring that the network infrastructure remains operational and efficient.

- Consulting: Advising clients on the best fiber optic solutions to meet their specific needs.

You may choose to specialize in one area or offer a combination of services to both residential and commercial clients. For instance, some businesses might focus exclusively on commercial clients who need robust fiber networks for large office buildings, while others may offer high-speed internet solutions to residential customers.

Build a Reliable Fiber Optic Network

One of the biggest challenges and investments in a fiber optic business is building the network infrastructure. You’ll need to source high-quality equipment such as fiber optic cables, routers, switches, and connectors. Partnering with reputable suppliers will be key to ensuring the reliability of your network.

Additionally, you will need to assemble a team of skilled technicians. These professionals should have experience in fiber optic installation, troubleshooting, and maintenance. Offering regular training can help keep your team up to date with industry standards and best practices.

Obtain Necessary Licenses and Permits

Starting a fiber optic business requires compliance with various regulations. Before beginning operations, ensure you have all the necessary licenses and permits. This may include:

- Telecommunications licenses: Depending on your location, you may need special permits to operate in the telecommunications industry.

- Building permits: These are often required if you are installing fiber optic infrastructure in public or private properties.

- Environmental clearances: Ensure compliance with any environmental regulations that might affect fiber optic cable installations, especially in protected areas.

Proper documentation will not only keep your business compliant but also prevent costly legal hurdles in the future.

Secure Funding and Develop a Business Plan

Building a fiber optic network requires significant capital investment. To attract investors or secure loans, you’ll need a comprehensive business plan. Your plan should include:

- A detailed market analysis

- Financial projections for the next 3–5 years

- A clear growth strategy

- A breakdown of the required capital for infrastructure and staffing

Many governments offer grants or incentives for telecommunications projects, so be sure to explore all available funding options.

Implement a Marketing Strategy

To grow your customer base, you’ll need a robust marketing strategy that leverages both online and offline channels. This can include:

- Website: Create a professional website showcasing your services, testimonials, and case studies.

- Social media: Use platforms like LinkedIn, Facebook, and Twitter to connect with potential customers and partners.

- Networking: Attend local business events and collaborate with other companies to spread the word about your fiber optic services.

Utilizing search engine optimization (SEO) on your website and content marketing can also help your business rank higher in search results, making it easier for potential customers to find you.

Prioritize Customer Satisfaction

In the highly competitive fiber optic industry, customer satisfaction is key to building a loyal client base. Offering exceptional service at every stage—from installation to troubleshooting—will help you maintain a good reputation.

Here’s how you can focus on customer satisfaction:

- Respond promptly to customer inquiries and complaints

- Offer warranties on your services

- Provide clear, transparent pricing

- Exceed customer expectations whenever possible

Building a reputation for reliability and excellent service can generate positive word of mouth, which is invaluable for business growth.

Business Insurance for Fiber Optic Cable Services

An often-overlooked aspect of starting a fiber optic business is securing appropriate business insurance. Given the technical and infrastructure-intensive nature of this industry, insurance can protect your business from a wide range of risks.

Types of Business Insurance You May Need

- General Liability Insurance: This covers legal claims arising from third-party bodily injury or property damage. For example, if your fiber optic installation causes damage to a client’s property, this insurance will help cover the cost of repairs or legal expenses.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this covers claims of negligence or mistakes in your service. If a client suffers financial loss due to a poorly installed fiber optic network, this insurance will protect you from costly lawsuits.

- Commercial Property Insurance: This is essential if you have office space, warehouses, or valuable equipment like fiber optic cables and tools. It helps cover the repair or replacement of equipment damaged by fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Since fiber optic installation involves physical labor, accidents on the job are always a risk. Workers’ compensation insurance helps cover medical expenses and lost wages if one of your technicians is injured while working.

- Business Interruption Insurance: In the event of a disaster that halts your operations, business interruption insurance helps cover lost income and ongoing expenses until you’re back up and running.

Having adequate insurance coverage will give you peace of mind and ensure that your business is protected against unforeseen events.

Conclusion

Starting a fiber optic business is an exciting opportunity in a fast-growing industry. With careful planning, a strong marketing strategy, and a commitment to quality service, your business can thrive in this competitive market. Additionally, don’t overlook the importance of securing the right insurance to protect your investment. By following these steps, you’ll be well on your way to building a successful fiber optic business that meets the ever-growing demand for high-speed internet connectivity.

Essential Truck Insurance Requirements Explained

Truck insurance can be a complex topic, especially for new truckers entering the business. This guide breaks down some of the most common insurance requirements to help you make informed decisions when buying your truck insurance policy.

Understanding these requirements is crucial for protecting your business, meeting legal obligations, and avoiding costly mistakes. Here, we’ll discuss four key types of coverage: auto liability, physical damage, motor truck cargo, and trailer interchange, as well as some tips for new owner-operators.

Auto Liability Insurance (Truck insurance)

Auto liability insurance, also known as primary liability, is mandatory for all commercial trucks as per the Federal Motor Carrier Safety Administration (FMCSA). This coverage helps pay for injuries and property damage caused to others if you’re at fault in an accident. For example, if your truck crashes into another vehicle, auto liability insurance will cover medical bills and repair costs for the other party.

The minimum coverage requirements depend on the type of freight you haul. For non-hazardous freight, the minimum coverage is $750,000. However, most brokers require a coverage of $1 million. If you haul hazardous materials or carry more than 15 passengers, the minimum requirement increases to $5 million. It’s essential to verify the specific requirements for your operation to ensure compliance and adequate protection.

Physical Damage Coverage

While auto liability covers damage to others, physical damage coverage protects your truck. It covers the cost of repairs or replacement of your truck up to the value you declare to your insurance agent. For example, if your truck is valued at $30,000 and it’s damaged in an accident, physical damage coverage will pay up to $30,000 for repairs or replacement.

This coverage is not required by the FMCSA, but it is often mandatory if you’re financing your truck. Even if it’s not required, it’s a wise investment as it protects your business from significant out-of-pocket expenses due to accidents, fire, theft, or vandalism. The cost of physical damage coverage varies depending on your truck’s value, age, and your chosen deductible.

Motor Truck Cargo Coverage (Truck insurance)

Motor truck cargo insurance provides protection for the goods you’re hauling. It covers losses resulting from fire, collision, or striking of a load. However, basic cargo policies may not cover specific scenarios such as theft, water damage, or refrigeration breakdown.

For instance, if your truck’s refrigeration unit malfunctions, causing your cargo to spoil, a basic cargo policy might not cover the loss. In another example, if you’re involved in an accident and your cargo spills onto the highway, cleanup costs may not be covered. Brokers typically require a minimum of $100,000 in cargo coverage, but it’s important to have sufficient coverage tailored to the type of goods you transport to avoid any financial pitfalls.

Also Read: Comprehensive Guide to Car Insurance

Trailer Interchange Coverage

Trailer interchange insurance is designed for truckers hauling non-owned trailers under a trailer interchange agreement. This coverage protects the trailer in case of damage due to collision, fire, theft, explosion, or vandalism while it’s in your possession.

For example, if your truck and a non-owned trailer are stolen while you’re refueling, and you don’t have trailer interchange coverage, your regular physical damage insurance won’t cover the trailer. With trailer interchange coverage, if you selected a limit of $20,000 and your deductible is $1,000, you would pay the first $1,000, and your insurance would cover the remaining $19,000. It’s crucial to ensure you have the right amount of coverage to avoid financial losses in case of such incidents.

Additional Insurance Coverages to Consider

Beyond these four basic coverages, there are other non-mandatory but highly recommended insurance options that can protect you from significant financial risks. These include:

- General Liability Insurance: Covers damages that occur during business operations not directly related to the operation of your truck, such as a customer slipping and falling on your property.

- Bobtail Insurance: Provides coverage when you’re driving your truck without a trailer attached, typically after a delivery.

- Non-Trucking Liability Insurance: Covers your truck when you’re using it for non-business purposes, such as personal errands.

- Occupational Accident Insurance: Offers benefits to independent contractors for injuries sustained while on the job, covering medical expenses, disability, and death benefits.

Tips for New Owner-Operators

For those new to the trucking business, navigating insurance can be overwhelming. Here are some tips to help you get started:

- Activate Your Operating Authority: If you’re looking to activate your operating authority but don’t have everything in place, consider obtaining a minimum insurance policy to “age” your motor carrier (MC) number. This strategy allows you to build up six months to a year of experience before fully launching your business, which can help you secure better insurance rates and contracts with companies like Amazon.

- Consult with a Specialist: Working with an insurance agent who specializes in truck insurance can help you tailor your coverage to your specific needs and avoid gaps that could put your business at risk.

- Regularly Review and Update Your Policy: As your business grows, your insurance needs may change. Regularly reviewing and updating your policy ensures that you’re adequately covered as your operations expand.

- Understand Broker Requirements: Brokers often have specific insurance requirements that exceed the legal minimums. Ensure you understand these requirements to avoid losing business opportunities.

By understanding these insurance requirements and proactively managing your coverage, you can protect your trucking business from potential risks and set yourself up for long-term success. Remember, insurance is not just a legal obligation but a crucial investment in your business’s future stability and growth.