Your cart is currently empty!

Blog

Health Insurance for Weight Loss Surgery

Weight loss surgery, also known as bariatric surgery, can be a life-changing solution for individuals struggling with severe obesity and its related health complications. However, one of the major hurdles many people face is the financial burden of the procedure. Health insurance can play a crucial role in making this type of surgery more accessible.

In this blog, we’ll dive deep into what you need to know about health insurance for weight loss surgery, the approval process, and how to navigate potential denials.

Topic Key Information Weight Loss Surgery Medical procedure to treat severe obesity (e.g., gastric bypass, sleeve gastrectomy). Health Insurance Coverage Most major insurers, Medicaid, and Medicare may cover surgery under specific conditions. Requirements for Coverage BMI over 40, or 35 with obesity-related conditions; documentation of failed weight loss attempts. Pre-Approval Process Medical evaluation, supervised weight loss program, nutritional and psychological evaluations. Maximizing Insurance Approval Stay organized, work with bariatric specialists, understand co-pays and deductibles. Dealing with Denials File an appeal with additional medical documentation and support from your doctor. Alternatives to Insurance Self-pay, medical tourism, financial assistance programs. Future of Coverage Growing advocacy for wider insurance coverage and recognition of bariatric surgery as a necessary intervention. an overview of the article Understanding Weight Loss Surgery and Its Importance

Weight loss surgery is not just about shedding pounds for cosmetic reasons. It’s a medical intervention designed to help individuals with obesity, particularly those whose health is at risk due to excess weight. Obesity is often linked to serious conditions such as type 2 diabetes, heart disease, high blood pressure, and sleep apnea. For many, bariatric surgery is a last resort after years of unsuccessful dieting, exercise programs, and lifestyle changes.

Several types of weight loss surgeries exist, with gastric bypass and sleeve gastrectomy being among the most common. These surgeries alter the digestive system to reduce food intake or nutrient absorption, leading to significant weight loss. However, because these procedures are complex and require long-term follow-up care, they can be costly without insurance coverage.

Does Health Insurance Cover Weight Loss Surgery?

One of the first questions many people ask is, “Does my health insurance cover weight loss surgery?” The answer depends on several factors, including your specific insurance plan and whether you meet the medical criteria for surgery.

Most major insurance providers, including employer-sponsored health plans, Medicaid, and Medicare, do offer coverage for bariatric surgery under certain conditions. However, not all plans automatically include weight loss surgery as part of their coverage. It’s essential to review your plan details or speak with your insurance provider to confirm whether you’re eligible.

Requirements for Health Insurance Coverage of Weight Loss Surgery

While many insurance plans do cover weight loss surgery, there are typically strict requirements to qualify for coverage. Insurance companies often label bariatric surgery as a “medically necessary” procedure, meaning it must be deemed essential for your health rather than elective.

To qualify for coverage, you’ll usually need to meet certain medical criteria. These criteria often include having a body mass index (BMI) over 40, or over 35 if you also suffer from obesity-related conditions like diabetes, heart disease, or high blood pressure. Some plans may also require proof of unsuccessful attempts at non-surgical weight loss methods, such as diet and exercise programs.

Additionally, your insurance provider may ask for documentation, such as a history of weight-related medical issues, a referral from your doctor, or records of medically supervised weight loss attempts.

The Pre-Approval Process for Bariatric Surgery

Before you can undergo weight loss surgery, you’ll need to go through a pre-approval process with your insurance company. This process ensures that you meet the necessary qualifications and that your insurance will cover the surgery costs.

Here’s a breakdown of the common steps involved:

- Medical Evaluation: Your doctor will evaluate your health to determine if bariatric surgery is a suitable option. This evaluation includes reviewing your BMI, medical history, and any related health conditions.

- Supervised Weight Loss Program: Many insurance companies require you to participate in a medically supervised weight loss program before approving surgery. These programs often last several months and are designed to show that you’ve made efforts to lose weight without surgery.

- Nutritional and Psychological Evaluations: Insurers typically require you to meet with a nutritionist and undergo a psychological evaluation to ensure you understand the lifestyle changes required post-surgery and are mentally prepared for the procedure’s demands.

- Insurance Pre-Authorization: Once all required documentation and evaluations are complete, your doctor’s office will submit a pre-authorization request to your insurance company. This request includes detailed medical information and justifications for why the surgery is necessary.

The pre-approval process can take weeks or even months, so it’s essential to start early and work closely with your healthcare provider to gather all the necessary documentation.

Also Read: Does Insurance Cover Wisdom Teeth Removal

Maximizing Your Chances of Insurance Approval

Navigating the health insurance process for weight loss surgery can be complex, but there are steps you can take to improve your chances of getting approved:

- Stay Organized: Keep thorough records of all medical evaluations, diet attempts, and required appointments. Having organized documentation will make it easier to meet your insurance provider’s requirements.

- Work with a Bariatric Surgeon’s Office: Many bariatric surgery practices have insurance specialists who are familiar with the approval process. They can help you navigate the steps, ensuring you meet all the requirements and submit the necessary paperwork.

- Understand Your Insurance Plan: Review your plan to understand what is covered, including co-pays, deductibles, and any out-of-pocket costs you may incur. Knowing the financial side of things upfront will help you prepare for any expenses that arise.

- Consider Alternative Options: If your insurance doesn’t cover a particular procedure or has strict requirements, you may want to explore alternatives, such as changing your insurance plan during open enrollment or looking into a supplemental insurance policy.

Dealing with Insurance Denials and the Appeal Process

Unfortunately, not all insurance claims for weight loss surgery are approved on the first try. It’s common to face initial denial, but that doesn’t mean the door is closed. Denials can happen for several reasons, such as insufficient documentation or failure to meet certain medical criteria.

If your claim is denied, it’s crucial to act quickly and follow your insurance company’s appeal process. Most insurers have a structured process that allows you to contest their decision by providing additional information or clarifications. This may involve submitting more medical evidence, a letter of medical necessity from your doctor, or completing additional weight loss programs.

Working with a healthcare advocate or legal professional can also increase your chances of a successful appeal if you’re having trouble navigating the process.

What to Do If Your Insurance Doesn’t Cover Weight Loss Surgery

If your insurance plan does not cover weight loss surgery, there are still several options to consider:

- Self-Pay: Some individuals choose to pay for the surgery out of pocket. Many bariatric surgeons offer financing plans or payment options to make this more feasible. However, this can be costly, with prices ranging from $15,000 to $25,000 or more.

- Medical Tourism: Traveling abroad for weight loss surgery is another option. Countries like Mexico, Costa Rica, and India offer bariatric surgery at a fraction of the cost compared to the U.S. However, there are risks associated with medical tourism, including language barriers, follow-up care challenges, and potential complications.

- Financial Assistance Programs: Some hospitals and clinics offer financial assistance or charity care programs for patients who qualify. You may also find non-profit organizations that provide grants or financial aid for bariatric surgery.

The Future of Weight Loss Surgery and Health Insurance

As awareness of obesity as a public health issue grows, there are signs that insurance coverage for weight loss surgery may expand. Advocacy groups are working to ensure that more insurance companies recognize bariatric surgery as a necessary medical intervention rather than an elective procedure.

Changes in healthcare legislation and policy, such as the Affordable Care Act, have also increased access to bariatric surgery for many individuals. As the conversation around obesity evolves, it’s likely that more people will gain access to the treatments they need to live healthier lives.

Final Thoughts

Health insurance can be a game-changer when it comes to accessing weight loss surgery. However, understanding your insurance plan, meeting medical criteria, and navigating the approval process are essential steps to ensuring your surgery is covered. By being proactive, staying organized, and working closely with your healthcare provider, you can improve your chances of getting insurance approval and embarking on your weight loss journey with confidence.

How to save on rising auto insurance costs practical tips for 2024

In recent years, car insurance premiums have surged, creating a financial strain for many families. In 2024, the average cost for full auto insurance in the United States rose by 26%, reaching $2,543 annually. This spike in premiums can be attributed to several factors, including fewer auto mechanics, rising healthcare costs, and increased litigation. These trends, combined with reckless driving habits and expensive vehicle repairs, have driven up the cost of insuring a car.

Section Title Description Introduction Overview of rising auto insurance premiums. Reasons for Rising Costs Factors driving the increase in auto insurance rates. Impact on Consumers How rising costs affect middle-class families. How to Save on Insurance Practical tips to reduce auto insurance premiums. Rising Auto Insurance Costs: What’s Behind the Spike?

Auto insurance premiums have experienced dramatic increases due to various factors impacting the industry. Here are the primary reasons behind the escalating costs:

- Supply Chain Disruptions and Inflation:

During the COVID-19 pandemic, fewer drivers were on the road, resulting in fewer accidents. In response, many insurers issued refunds to their customers. However, as the economy reopened and inflation soared, insurers faced increased costs for vehicle repairs, spare parts, and labor. This shift led to significant premium hikes. By 2022, U.S. auto insurers experienced some of their worst underwriting results in over two decades, as the costs of claims surpassed the premiums collected. - Reckless Driving and Distracted Driving:

In recent years, distracted driving, particularly due to mobile phone usage, has become a growing concern. More drivers are engaging in unsafe behaviors, such as texting or using their phones while driving. This rise in distracted driving has contributed to an increase in car accidents, putting further pressure on insurance companies to raise premiums to cover these claims. - Increased Vehicle Repair Costs:

Modern vehicles are becoming more complex, with advanced safety features and technology. While these innovations improve driver safety, they also make vehicles more expensive to repair. Insurers must cover these costly repairs, which translates into higher premiums for drivers. - Litigation and Healthcare Costs:

Legal battles following car accidents and rising healthcare expenses also play a role in driving up insurance premiums. As medical bills and litigation costs continue to climb, insurers must adjust their rates accordingly.

How Auto Insurance Rates Are Set

Insurance companies use a variety of factors to calculate auto insurance premiums, and not everyone pays the same amount. Key factors that impact your rate include:

- Vehicle Type: Certain cars are more expensive to insure due to their repair costs or safety ratings.

- Driving Record: A clean driving record can result in lower premiums, while accidents or traffic violations may lead to higher costs.

- Credit Score: In many states, insurers use a credit-based insurance score to assess risk. Drivers with excellent credit scores often pay lower premiums than those with poor credit, even if they have a clean driving record. However, states like California, Massachusetts, and Hawaii have banned the use of credit scores for setting rates.

- Location: Your home address can affect your insurance premium. For example, drivers in predominantly minority communities have been found to pay higher premiums compared to those in non-minority areas.

- Socioeconomic Factors: Factors such as job title, education level, marital status, and homeownership can influence your insurance costs.

Impact of Rising Premiums on Consumers

As insurance rates continue to rise, many drivers are feeling the financial strain. Families like Dawn King’s in suburban New Jersey, where public transportation is limited, are particularly affected. With four cars to insure, Dawn’s family saw their insurance premium jump from $3,100 in 2023 to $3,900 in 2024, for a six-month policy covering four drivers. For middle-class families, the constant increase in premiums is becoming unsustainable.

The rising costs are not only affecting families but also increasing the number of uninsured drivers. As premiums become unaffordable, more drivers are opting to go without insurance, putting themselves at risk for severe penalties, including fines, car impoundment, and even jail time.

How to Save on Auto Insurance

Despite rising costs, there are ways drivers can reduce their auto insurance premiums:

- Bundle Insurance Policies: One of the most effective ways to save is by bundling your home and auto insurance policies. Bundling can save you an average of 14% on your premiums.

- Shop Around for Better Rates: Insurance rates can vary between providers, so it’s important to shop around and compare quotes. Many insurance companies offer online tools to help you find the best rate.

- Increase Your Deductible: By choosing a higher deductible, you can lower your premium. However, make sure you can afford to pay the deductible in the event of an accident.

- Maintain a Good Credit Score: Since your credit score can significantly impact your insurance premium, maintaining good credit can help you secure a lower rate.

- Take Advantage of Discounts: Many insurers offer discounts for safe driving, completing a defensive driving course, or installing anti-theft devices in your vehicle. Be sure to ask about available discounts to reduce your premium.

- Pay Annually: Paying your premium in full for the year, rather than monthly, can sometimes lead to discounts and savings.

The Future of Auto Insurance

As car insurance premiums continue to rise, it’s important for drivers to understand the factors influencing their rates and take proactive steps to save money. While factors like inflation, vehicle complexity, and reckless driving may continue to push premiums higher, there are still ways to manage costs and find affordable coverage.

With over 215 million Americans owning auto insurance, the market was valued at approximately $353 billion in 2023. As insurers like Allstate and Progressive adjust their pricing strategies to remain profitable, consumers should stay informed and vigilant in seeking the best coverage at the most reasonable price.

By following these tips and keeping an eye on the industry, you can navigate the challenges of rising auto insurance rates and protect yourself and your family on the road.

- Supply Chain Disruptions and Inflation:

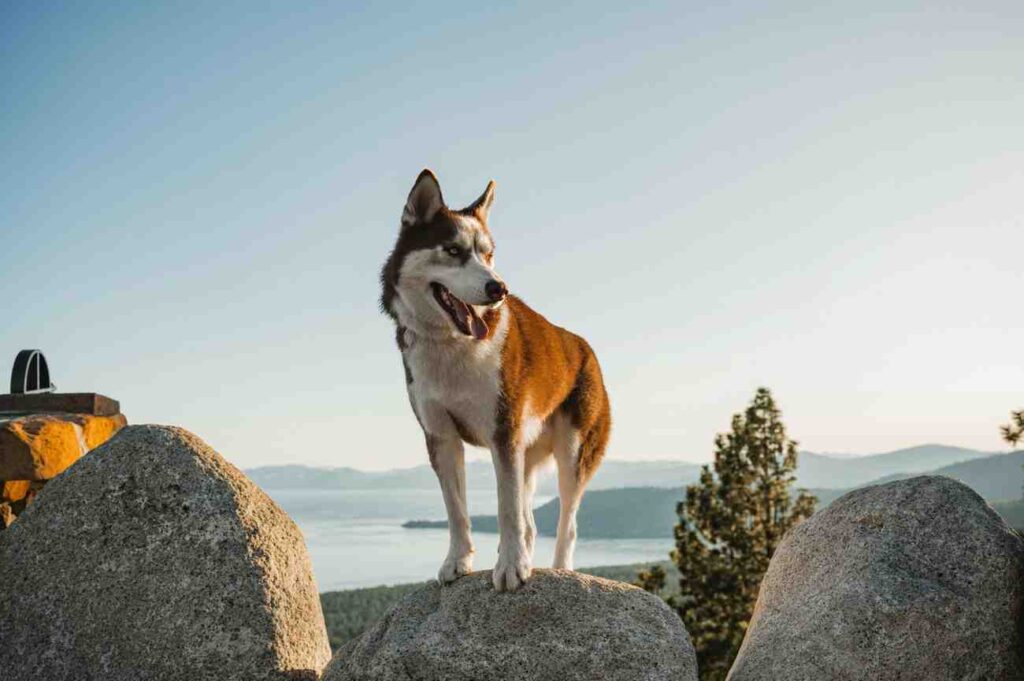

Essential Insurance for Your Pet Care Business

Running a pet care business is a rewarding experience, but like any other venture, it comes with its share of risks. Whether you’re offering pet grooming, boarding, dog walking, or other services, ensuring you have the right insurance coverage is crucial. Many pet care business owners may not realize the importance of business insurance or understand the variety of coverages available to protect their operations.

In this guide, we’ll explore the key insurance coverages you need for your pet care business, how they can protect you from common risks, and provide recommendations on where to get the right insurance plan.

Section Title Description Introduction Why business insurance is important for pet care. Types of Insurance General liability, professional liability, property, and workers’ compensation. Why You Need Insurance Real-life scenarios showing insurance protection. Choosing Insurance Tips on finding the right plan with the help of an agent. Why Your Pet Care Business Needs Insurance

Insurance serves as a safety net for your business, protecting you from unexpected incidents that could result in financial loss. In a pet care business, you’re not only responsible for the pets in your care but also for the safety of your clients and their property. Even if you take every precaution, accidents happen, and you want to be prepared for them.

The most essential coverage for a pet care business is Commercial General Liability Insurance (CGL). It protects your business from various types of claims that may arise, including bodily injury, property damage, and even legal defense costs. Below, we’ll break down four key components of a CGL policy and explain how they can benefit your business.

Third-Party Bodily Injury Coverage

One of the most common types of claims covered under general liability insurance is third-party bodily injury. This comes into play when a client, customer, or visitor is injured on your business property or while you’re providing a service.

Example: Imagine a client is dropping off their dog for grooming, and they trip over a piece of equipment or slip on a wet floor. The client falls, injures their elbow, and is unable to work for several weeks. Because you have general liability insurance, you can file a claim to cover the client’s medical expenses and lost wages, ensuring that you’re not paying out of pocket.

This type of coverage protects your business from the financial strain that could result from someone getting injured while interacting with your business. Even a minor injury could lead to costly medical bills and potential lawsuits, making bodily injury coverage a must-have.

Third-Party Property Damage Coverage

In addition to bodily injuries, your business can also be held responsible for damage to someone else’s property. If you or your staff accidentally damage a client’s property or a third party’s belongings, property damage coverage in your CGL policy will step in to cover repair or replacement costs.

Example: Let’s say you’re out walking a client’s dog, and the dog knocks over a large, expensive planter in front of a coffee shop. The coffee shop owner demands compensation for the damage. With general liability insurance, you can file a claim to cover the cost of replacing or repairing the planter, so you don’t have to pay for the damages out of pocket.

Accidents can happen at any time, and property damage coverage ensures that these incidents don’t negatively impact your business’s financial health.

Legal Defense Coverage

No matter how carefully you run your pet care business, you could still face unfounded legal claims. Even when you know you’ve done nothing wrong, defending your business in court can be expensive. This is where the legal defense component of general liability insurance can be invaluable.

Example: You offer pet grooming services, and a client claims that your grooming caused their dog to lose a $10,000 grand prize at a regional dog show. The client demands compensation for the loss, even though you know you performed the grooming to industry standards. In this situation, you may need to hire a lawyer to defend yourself. General liability insurance can cover the costs of your legal defense, so you don’t have to worry about the financial burden of hiring attorneys or dealing with court fees.

Legal defense coverage is essential for protecting your business from claims, whether they are valid or not, allowing you to defend your reputation and keep your operations running smoothly.

Medical Payments Coverage

In some cases, a client or visitor may need immediate medical attention due to an accident that occurs on your property or while you’re providing services. Medical payments coverage is designed to cover the injured party’s medical expenses, regardless of who is at fault.

Example: Returning to the scenario of the client with the injured elbow, let’s say their injury requires surgery, and you’re responsible for covering their medical co-pay. With commercial general liability insurance, you can make a claim to cover these medical expenses, helping you avoid paying out of pocket for costly procedures.

Medical payments coverage offers a layer of protection that ensures your business can handle medical claims swiftly and efficiently, reducing the potential for further legal action.

Choosing the Right Insurance Plan for Your Pet Care Business

Now that you understand the key coverages included in a general liability policy, it’s important to find the right insurance provider to protect your business. Different pet care businesses have unique risks and requirements, so working with an experienced insurance agent or broker is crucial. They can help tailor a policy that fits the specific needs of your business, ensuring you have the right coverage in place.

When choosing an insurance provider, consider the following:

- Reputation and experience: Look for insurers that specialize in small businesses and have a solid reputation in the industry.

- Comprehensive coverage options: Ensure that your policy includes all the necessary coverages, from general liability to workers’ compensation if you have employees.

- Customer service: Good communication and fast response times are essential when dealing with claims or policy changes.

Additional Insurance Coverages to Consider

While general liability insurance covers many of the risks your pet care business may face, there are other types of coverage you should consider:

- Workers’ Compensation Insurance: If you have employees, this insurance is required in most states. It covers medical expenses and lost wages for employees who are injured while working.

- Professional Liability Insurance (Errors & Omissions): This covers claims related to mistakes or negligence in the services you provide. For example, if a client claims that your grooming services harmed their pet’s health, this coverage can help with legal defense and damages.

- Business Property Insurance: This protects the physical assets of your business, such as your facility, equipment, and supplies, in case of fire, theft, or natural disasters.

- Business Interruption Insurance: If an event like a fire or storm forces you to temporarily close your business, this insurance can help cover lost income and operating expenses during the downtime.

Conclusion

Running a pet care business comes with its own unique set of challenges and risks, but having the right insurance coverage in place can give you peace of mind. By understanding the importance of general liability insurance and its various coverages—such as bodily injury, property damage, legal defense, and medical payments—you can protect your business from unexpected financial hardships.

To ensure you have the best protection for your business, consult with an insurance professional who understands the pet care industry. They can guide you through the process of finding the right policy tailored to your specific needs. With the right coverage, you can focus on what you do best—caring for pets—while knowing that your business is safeguarded.

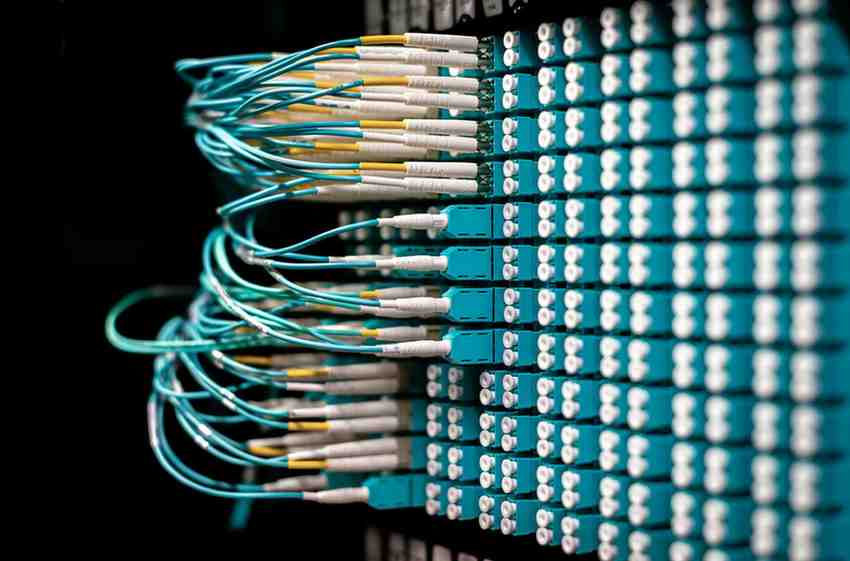

How to Start a Fiber Optic Business

The fiber optic industry is experiencing rapid growth, driven by the increasing demand for high-speed internet and advanced communication technologies. Starting a fiber optic business can be a lucrative venture, especially for those who are tech-savvy and ready to navigate a complex but rewarding market. This guide will walk you through the essential steps of launching your own fiber optic business, from market research to customer satisfaction, as well as important considerations like business insurance for fiber optic cable services.

Conduct In-Depth Market Research

The foundation of any successful business is thorough research, and the fiber optic sector is no different. Start by investigating the demand for fiber optic services in your target area. Determine whether there is a market gap for faster, more reliable internet connectivity, especially for sectors such as businesses, educational institutions, healthcare facilities, and government agencies.

Section Title Description Introduction Overview of the fiber optic industry’s growth and opportunity. Understanding the Fiber Optic Industry Key types of fiber optic cables and their applications. Steps to Start a Fiber Optic Business Market research, business planning, and necessary permits. Building Your Team Hiring skilled technicians and partnering with suppliers. Marketing and Growth Effective marketing strategies and client relationships. A comprehensive market analysis will help you:

- Identify your target audience (residential, commercial, or both)

- Understand the services offered by existing competitors

- Spot untapped opportunities or underserved areas

- Build a competitive advantage for your business

By knowing where the demand lies and what the competition is offering, you can better define your business’s unique selling proposition (USP) and shape your service offerings to cater to specific customer needs.

Define Your Fiber Optic Services

Once you’ve identified a viable market opportunity, it’s crucial to clearly define the range of services your fiber optic business will provide. Fiber optic infrastructure typically includes a range of services such as:

- Installation: Setting up the fiber optic cables and necessary hardware.

- Maintenance: Ensuring that the network infrastructure remains operational and efficient.

- Consulting: Advising clients on the best fiber optic solutions to meet their specific needs.

You may choose to specialize in one area or offer a combination of services to both residential and commercial clients. For instance, some businesses might focus exclusively on commercial clients who need robust fiber networks for large office buildings, while others may offer high-speed internet solutions to residential customers.

Build a Reliable Fiber Optic Network

One of the biggest challenges and investments in a fiber optic business is building the network infrastructure. You’ll need to source high-quality equipment such as fiber optic cables, routers, switches, and connectors. Partnering with reputable suppliers will be key to ensuring the reliability of your network.

Additionally, you will need to assemble a team of skilled technicians. These professionals should have experience in fiber optic installation, troubleshooting, and maintenance. Offering regular training can help keep your team up to date with industry standards and best practices.

Obtain Necessary Licenses and Permits

Starting a fiber optic business requires compliance with various regulations. Before beginning operations, ensure you have all the necessary licenses and permits. This may include:

- Telecommunications licenses: Depending on your location, you may need special permits to operate in the telecommunications industry.

- Building permits: These are often required if you are installing fiber optic infrastructure in public or private properties.

- Environmental clearances: Ensure compliance with any environmental regulations that might affect fiber optic cable installations, especially in protected areas.

Proper documentation will not only keep your business compliant but also prevent costly legal hurdles in the future.

Secure Funding and Develop a Business Plan

Building a fiber optic network requires significant capital investment. To attract investors or secure loans, you’ll need a comprehensive business plan. Your plan should include:

- A detailed market analysis

- Financial projections for the next 3–5 years

- A clear growth strategy

- A breakdown of the required capital for infrastructure and staffing

Many governments offer grants or incentives for telecommunications projects, so be sure to explore all available funding options.

Implement a Marketing Strategy

To grow your customer base, you’ll need a robust marketing strategy that leverages both online and offline channels. This can include:

- Website: Create a professional website showcasing your services, testimonials, and case studies.

- Social media: Use platforms like LinkedIn, Facebook, and Twitter to connect with potential customers and partners.

- Networking: Attend local business events and collaborate with other companies to spread the word about your fiber optic services.

Utilizing search engine optimization (SEO) on your website and content marketing can also help your business rank higher in search results, making it easier for potential customers to find you.

Prioritize Customer Satisfaction

In the highly competitive fiber optic industry, customer satisfaction is key to building a loyal client base. Offering exceptional service at every stage—from installation to troubleshooting—will help you maintain a good reputation.

Here’s how you can focus on customer satisfaction:

- Respond promptly to customer inquiries and complaints

- Offer warranties on your services

- Provide clear, transparent pricing

- Exceed customer expectations whenever possible

Building a reputation for reliability and excellent service can generate positive word of mouth, which is invaluable for business growth.

Business Insurance for Fiber Optic Cable Services

An often-overlooked aspect of starting a fiber optic business is securing appropriate business insurance. Given the technical and infrastructure-intensive nature of this industry, insurance can protect your business from a wide range of risks.

Types of Business Insurance You May Need

- General Liability Insurance: This covers legal claims arising from third-party bodily injury or property damage. For example, if your fiber optic installation causes damage to a client’s property, this insurance will help cover the cost of repairs or legal expenses.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this covers claims of negligence or mistakes in your service. If a client suffers financial loss due to a poorly installed fiber optic network, this insurance will protect you from costly lawsuits.

- Commercial Property Insurance: This is essential if you have office space, warehouses, or valuable equipment like fiber optic cables and tools. It helps cover the repair or replacement of equipment damaged by fire, theft, or natural disasters.

- Workers’ Compensation Insurance: Since fiber optic installation involves physical labor, accidents on the job are always a risk. Workers’ compensation insurance helps cover medical expenses and lost wages if one of your technicians is injured while working.

- Business Interruption Insurance: In the event of a disaster that halts your operations, business interruption insurance helps cover lost income and ongoing expenses until you’re back up and running.

Having adequate insurance coverage will give you peace of mind and ensure that your business is protected against unforeseen events.

Conclusion

Starting a fiber optic business is an exciting opportunity in a fast-growing industry. With careful planning, a strong marketing strategy, and a commitment to quality service, your business can thrive in this competitive market. Additionally, don’t overlook the importance of securing the right insurance to protect your investment. By following these steps, you’ll be well on your way to building a successful fiber optic business that meets the ever-growing demand for high-speed internet connectivity.

Essential Truck Insurance Requirements Explained

Truck insurance can be a complex topic, especially for new truckers entering the business. This guide breaks down some of the most common insurance requirements to help you make informed decisions when buying your truck insurance policy.

Understanding these requirements is crucial for protecting your business, meeting legal obligations, and avoiding costly mistakes. Here, we’ll discuss four key types of coverage: auto liability, physical damage, motor truck cargo, and trailer interchange, as well as some tips for new owner-operators.

Auto Liability Insurance (Truck insurance)

Auto liability insurance, also known as primary liability, is mandatory for all commercial trucks as per the Federal Motor Carrier Safety Administration (FMCSA). This coverage helps pay for injuries and property damage caused to others if you’re at fault in an accident. For example, if your truck crashes into another vehicle, auto liability insurance will cover medical bills and repair costs for the other party.

The minimum coverage requirements depend on the type of freight you haul. For non-hazardous freight, the minimum coverage is $750,000. However, most brokers require a coverage of $1 million. If you haul hazardous materials or carry more than 15 passengers, the minimum requirement increases to $5 million. It’s essential to verify the specific requirements for your operation to ensure compliance and adequate protection.

Physical Damage Coverage

While auto liability covers damage to others, physical damage coverage protects your truck. It covers the cost of repairs or replacement of your truck up to the value you declare to your insurance agent. For example, if your truck is valued at $30,000 and it’s damaged in an accident, physical damage coverage will pay up to $30,000 for repairs or replacement.

This coverage is not required by the FMCSA, but it is often mandatory if you’re financing your truck. Even if it’s not required, it’s a wise investment as it protects your business from significant out-of-pocket expenses due to accidents, fire, theft, or vandalism. The cost of physical damage coverage varies depending on your truck’s value, age, and your chosen deductible.

Motor Truck Cargo Coverage (Truck insurance)

Motor truck cargo insurance provides protection for the goods you’re hauling. It covers losses resulting from fire, collision, or striking of a load. However, basic cargo policies may not cover specific scenarios such as theft, water damage, or refrigeration breakdown.

For instance, if your truck’s refrigeration unit malfunctions, causing your cargo to spoil, a basic cargo policy might not cover the loss. In another example, if you’re involved in an accident and your cargo spills onto the highway, cleanup costs may not be covered. Brokers typically require a minimum of $100,000 in cargo coverage, but it’s important to have sufficient coverage tailored to the type of goods you transport to avoid any financial pitfalls.

Also Read: Comprehensive Guide to Car Insurance

Trailer Interchange Coverage

Trailer interchange insurance is designed for truckers hauling non-owned trailers under a trailer interchange agreement. This coverage protects the trailer in case of damage due to collision, fire, theft, explosion, or vandalism while it’s in your possession.

For example, if your truck and a non-owned trailer are stolen while you’re refueling, and you don’t have trailer interchange coverage, your regular physical damage insurance won’t cover the trailer. With trailer interchange coverage, if you selected a limit of $20,000 and your deductible is $1,000, you would pay the first $1,000, and your insurance would cover the remaining $19,000. It’s crucial to ensure you have the right amount of coverage to avoid financial losses in case of such incidents.

Additional Insurance Coverages to Consider

Beyond these four basic coverages, there are other non-mandatory but highly recommended insurance options that can protect you from significant financial risks. These include:

- General Liability Insurance: Covers damages that occur during business operations not directly related to the operation of your truck, such as a customer slipping and falling on your property.

- Bobtail Insurance: Provides coverage when you’re driving your truck without a trailer attached, typically after a delivery.

- Non-Trucking Liability Insurance: Covers your truck when you’re using it for non-business purposes, such as personal errands.

- Occupational Accident Insurance: Offers benefits to independent contractors for injuries sustained while on the job, covering medical expenses, disability, and death benefits.

Tips for New Owner-Operators

For those new to the trucking business, navigating insurance can be overwhelming. Here are some tips to help you get started:

- Activate Your Operating Authority: If you’re looking to activate your operating authority but don’t have everything in place, consider obtaining a minimum insurance policy to “age” your motor carrier (MC) number. This strategy allows you to build up six months to a year of experience before fully launching your business, which can help you secure better insurance rates and contracts with companies like Amazon.

- Consult with a Specialist: Working with an insurance agent who specializes in truck insurance can help you tailor your coverage to your specific needs and avoid gaps that could put your business at risk.

- Regularly Review and Update Your Policy: As your business grows, your insurance needs may change. Regularly reviewing and updating your policy ensures that you’re adequately covered as your operations expand.

- Understand Broker Requirements: Brokers often have specific insurance requirements that exceed the legal minimums. Ensure you understand these requirements to avoid losing business opportunities.

By understanding these insurance requirements and proactively managing your coverage, you can protect your trucking business from potential risks and set yourself up for long-term success. Remember, insurance is not just a legal obligation but a crucial investment in your business’s future stability and growth.

Does Insurance Cover Wisdom Teeth Removal?

Getting your wisdom teeth removed can be a significant expense, and one of the most common questions people ask is whether their insurance will cover the cost. The answer isn’t always straightforward, as coverage can depend on several factors including your type of insurance, the complexity of the extraction, and your specific plan. In this blog, we’ll break down what you need to know about insurance coverage for wisdom teeth removal.

What is Wisdom Teeth Removal?

Wisdom teeth, also known as third molars, are the last set of teeth to develop in your mouth, typically appearing in your late teens or early twenties. Many people need to have these teeth removed due to pain, overcrowding, or impaction, which occurs when the teeth don’t have enough space to emerge properly. The extraction can range from a simple procedure to a more complex surgery, depending on the position and condition of the teeth.

Insurance Type Coverage for Wisdom Teeth Removal Notes Dental Insurance Typically covers 50-80% if medically necessary Coverage varies by plan; deductible may apply Health Insurance May cover if deemed medically necessary (e.g., surgery) Usually applies for more complex procedures Medicare Rarely covers dental procedures, including wisdom teeth Only in specific emergency cases Medicaid Coverage varies by state, often for those under 21 Check state-specific coverage requirements Out-of-Pocket Costs $100 – $600 per tooth with insurance Without insurance: $200 – $1,000 per tooth Does Insurance Cover Wisdom Teeth Removal?

The short answer is that it depends on your insurance plan. Both dental and health insurance can potentially cover some or all of the cost of wisdom teeth removal. However, the specifics can vary widely.

Dental Insurance Coverage

Most dental insurance plans cover wisdom teeth removal if it is deemed medically necessary. This usually applies when the teeth are impacted, causing pain, or if there’s a risk of infection. Coverage can vary, but most plans cover a portion of the procedure, typically 50-80%, after you’ve met your deductible.

Also Read: Top Pet Insurance Companies of 2024 Revealed

Health Insurance Coverage

In some cases, health insurance may cover the cost of wisdom teeth removal, especially if the procedure is complex and involves oral surgery or hospitalization. This is more likely if your dentist or oral surgeon can demonstrate that the removal is essential for your overall health. For instance, if your wisdom teeth are causing sinus issues or other complications, health insurance might step in.

Medicare and Medicaid Coverage

Medicare usually doesn’t cover dental procedures, including wisdom teeth removal, unless it is part of a covered emergency procedure. Medicaid coverage for wisdom teeth removal varies by state, but it generally covers the procedure for those under 21 if it’s medically necessary.

Cost of Wisdom Teeth Removal with Insurance

The cost of wisdom teeth removal can vary depending on the complexity of the procedure and your location. With insurance, your out-of-pocket cost can range from $100 to $600 per tooth. Without insurance, this cost can increase to between $200 and $1,000 per tooth. Other factors, like the need for anesthesia, can also affect the final cost.

How to Check if Your Insurance Covers Wisdom Teeth Removal

To avoid unexpected expenses, it’s crucial to verify your insurance coverage before scheduling your wisdom teeth removal. Here’s how you can do it:

- Review Your Insurance Policy: Check your dental or health insurance policy documents for details about coverage for oral surgery or wisdom teeth removal.

- Contact Your Insurance Provider: Call your insurance company directly and ask if wisdom teeth removal is covered under your plan. Be sure to provide them with any necessary details about the procedure, including whether it is considered medically necessary.

- Get a Pre-Authorization: Many insurance plans require pre-authorization for surgical procedures. Ask your oral surgeon or dentist to submit a pre-authorization request to your insurance company. This will give you a clear picture of what is covered and what your out-of-pocket costs will be.

Tips for Reducing Out-of-Pocket Costs

If your insurance does not fully cover the cost of wisdom teeth removal, there are a few ways to reduce your out-of-pocket expenses:

- Use a Flexible Spending Account (FSA) or Health Savings Account (HSA): These accounts allow you to use pre-tax dollars to pay for eligible medical expenses, including dental procedures.

- Ask for Payment Plans: Many dental offices offer payment plans that allow you to spread the cost of the procedure over several months.

- Shop Around: Costs for wisdom teeth removal can vary significantly from one provider to another. Get quotes from multiple oral surgeons to find the best price.

Conclusion

Whether or not insurance covers wisdom teeth removal can be confusing, but with a little research and preparation, you can navigate the process more easily. Be sure to review your insurance policy, contact your provider, and get a pre-authorization to understand what your plan covers. With this information in hand, you can make an informed decision and avoid any surprise costs.

If you have any more questions about insurance coverage for wisdom teeth removal or want to explore your options, feel free to reach out to your dental provider or insurance company for personalized advice.

Top Pet Insurance Companies of 2024 Revealed

Pet insurance is a smart investment to protect yourself from unexpected veterinary expenses. Whether it’s a sudden illness or an unforeseen accident, having the right coverage can ease the financial burden of taking care of your furry friend.

This guide highlights the top pet insurance providers in 2024, comparing their plans, pricing, and features. We evaluated them on key factors such as coverage options, customer service, cost, and overall reputation. Read on to discover the best pet insurance companies that can help you keep your pet healthy without breaking the bank.

Lemonade: Best Overall Pet Insurance

Lemonade tops our list as the best overall pet insurance company, scoring 96 out of 100 for its comprehensive coverage, competitive pricing, and excellent customer service. Lemonade offers flexible plans that cater to various needs, from basic accident and illness coverage to comprehensive wellness care, making it an ideal choice for pet owners, whether you have a small cat or an active Golden Retriever.

Pros:

- Charitable giveback program.

- Short 48-hour waiting period for accidents.

- No age limits for coverage.

Cons:

- Does not cover behavioral treatments.

- Limited availability of veterinary care services in only 35 states.

Why We Chose Lemonade

Lemonade’s plans are affordably priced, making them accessible to many pet owners. Customers can select from various coverage limits, reimbursement rates, and deductible options. The company also offers an optional Wellness Plan for routine care and an affordable add-on for comprehensive vet fee coverage, which includes acupuncture and therapy.

One of Lemonade’s standout features is its user-friendly mobile app equipped with AI technology, simplifying the process of filing claims and managing policies. This technology enhances the overall user experience, making it easy for pet owners to handle their insurance needs without hassle.

Plans and Pricing

Lemonade offers a primary accident and illness plan, with additional options for preventive care, vet visit fees, and physical therapy. Exclusions include pre-existing conditions, behavioral treatments, elective cosmetic procedures, and dental care. Based on our research, monthly premiums range from $15 to $30 for dogs and $9 to $15 for cats.

Also Read: 6 Great Advice To New Insurance Agents

Spot: Most Customizable Plans

Spot is recognized for providing the most customizable plans, scoring 91 out of 100. It offers a wide range of coverage options, including accident-only and comprehensive accident and illness plans, making it a great choice for pet owners who want flexibility in their insurance coverage.

Pros:

- Standard plans include microchipping.

- Offers a 10% discount for multiple pets.

- Unlimited coverage options available.

Cons:

- Does not cover pets under eight weeks old.

- Long 14-day waiting period for accidents.

Why We Chose Spot

Spot stands out for its extensive customization options. Customers can choose from seven annual coverage limits ranging from $2,500 to unlimited, three reimbursement levels, and five annual deductibles. This flexibility allows pet owners to tailor their plans to meet their specific needs and budget. Additionally, Spot offers one of the lowest-priced accident-only plans, ideal for those looking for basic coverage.

Plans and Pricing

Spot offers two primary plans: accident-only and accident and illness coverage. Both include exam and vet visit fees. Spot also offers two preventive care options, Gold and Platinum, at flat rates for routine care. Exclusions include pre-existing conditions, cosmetic procedures, and breeding costs. Monthly premiums are between $15 and $25 for dogs and $10 to $15 for cats.

Embrace: Best for Deductibles

Embrace is our top pick for the best deductible options, scoring 93.5 out of 100. It provides flexible and affordable coverage options, making it a great choice for pet owners looking to manage their costs effectively.

Pros:

- Online chat for customer service.

- Covers exam fees.

- Easy policy management through a mobile app.

Cons:

- Highest annual coverage limit is $30,000.

- Limited customer service hours.

Why We Chose Embrace

Embrace offers various ways to lower your premium, including five deductible options and a Healthy Pet Deductible benefit. This unique feature reduces your deductible by $50 each year you don’t file a claim, rewarding responsible pet owners.

Embrace’s user-friendly online platform and mobile app make it easy to manage your policy, file claims, and access customer support. However, the highest annual coverage limit is $30,000, which might be limiting for pet owners seeking higher coverage.

Plans and Pricing

Embrace offers a single accident and illness plan with optional add-ons for Wellness Rewards, covering routine care like vet exams and vaccinations. Exclusions include pre-existing conditions and elective procedures. Monthly premiums range from $25 to $55 for dogs and $20 to $30 for cats.

Choosing the Right Pet Insurance: Key Factors to Consider

When choosing pet insurance, it’s essential to consider factors such as coverage options, exclusions, deductibles, and overall cost. Here’s a breakdown of what to look for when selecting the best plan for your pet:

Coverage Options

Most pet insurance plans cover accidents and illnesses, but the level of coverage can vary widely. Look for plans that cover a wide range of conditions, including chronic illnesses, hereditary conditions, and alternative therapies like acupuncture or physical therapy.

Exclusions

All pet insurance plans have exclusions, which are conditions or treatments not covered by the policy. Common exclusions include pre-existing conditions, cosmetic procedures, and breeding costs. It’s crucial to read the fine print and understand what’s not covered before choosing a plan.

Deductibles and Reimbursement Rates

Deductibles are the amount you pay out-of-pocket before the insurance coverage kicks in. Choose a deductible that aligns with your budget. Higher deductibles usually mean lower monthly premiums but more out-of-pocket costs when you make a claim. Reimbursement rates indicate how much the insurer will pay after you’ve met the deductible, typically ranging from 70% to 90%.

Cost and Value

The cost of pet insurance varies depending on factors like your pet’s age, breed, and location. Monthly premiums can range from $10 to $100 or more. It’s essential to balance cost and coverage to find a plan that offers the best value for your needs.

Final Thoughts

Pet insurance can provide peace of mind and financial security when your pet needs medical attention. Lemonade, Spot, and Embrace each offer unique benefits, making them the top choices for different needs and preferences. Whether you’re looking for comprehensive coverage, customization options, or affordable deductibles, one of these providers is sure to meet your requirements.

Before making a decision, compare quotes and read the policy details carefully to ensure you choose the best insurance plan for your furry friend. Investing in pet insurance is a proactive step toward ensuring your pet’s health and well-being without the worry of unexpected expenses.

For more detailed reviews and information on other pet insurance providers, stay tuned and explore our in-depth guides and resources. Don’t forget to like, comment, and subscribe for more updates on pet care and insurance.

6 Great Advice To New Insurance Agents

Every entrepreneur or business professional reaches a critical crossroads at some point in their career, where the challenges seem insurmountable, and quitting feels like a viable option. For insurance agents or anyone in sales, the emotional roller coaster of rejection, slow progress, and uncertainty can be overwhelming. It’s easy to feel like you’re just not cut out for it, especially when the odds seem stacked against you. But before you decide to quit, it’s important to take a step back and understand a few key things.

The Reality: 92% Don’t Make It (Insurance agents)

In any high-pressure industry like insurance or sales, it’s widely accepted that a large percentage of people don’t make it. The figure often quoted is that 92% of agents quit within the first few years. This statistic can either be disheartening or it can serve as a rallying cry, depending on how you choose to perceive it. If you’re considering quitting, think about whether you want to be a part of that 92%, or whether you want to push yourself to become one of the 8% who defy the odds.

Challenges in Insurance Insurance Agents quit due to early struggles but perseverance is key. 5-Year Commitment Success typically comes after 5 years of dedication. (remember Insurance Agents…) Building Success Create a replicable system for lead generation and agent development. Avoiding Burnout Reassess your strategy and make adjustments before quitting. Recruiting Agents A strong system helps recruit and develop successful Insurance Agents. The Story of the Pizza Shop Owners

A relevant example can be found in a conversation with a husband-and-wife team who owned a successful pizza shop. These entrepreneurs were making several hundred thousand dollars annually, but the pressures of the business, exacerbated by the pandemic, led them to consider switching industries. They wondered if they could find something easier or more profitable. They believed that perhaps their success in another field would come quicker or with less hardship.

When challenged on whether they wanted to leave because the business was genuinely unfulfilling or simply because it had become difficult, they admitted that it was the latter. It wasn’t that they didn’t love their pizza shop—they were simply tired of the struggle. But like any long-term relationship, be it with a business or a person, there are tough moments. The easy road is to walk away when things get hard, but that may not always be the best solution.

Also Read: 5 Essential Reasons Why You Needs Business Insurance

Business and Marriage: The Comparison

Just like in marriage, there are times in business when it feels easier to give up. But before making such a monumental decision, consider going through the equivalent of “business therapy.” Commit to staying the course for a specific amount of time—whether it’s another six months or a year—and give it everything you’ve got during that period. You wouldn’t walk away from a marriage without trying to resolve the issues first, so why would you walk away from a business without making the same effort?

The most successful entrepreneurs often talk about the point at which they almost gave up. Those moments of doubt are universal, but pushing through them often leads to unimaginable success. For every agent who quits, there’s another who pushed just a little bit further and reaped enormous rewards. The question is, which one do you want to be?

The Five-Year Rule

Success in industries like insurance doesn’t happen overnight. It takes time to build a business, learn the ropes, and develop the relationships necessary to thrive. In fact, the first five years are often referred to as a period of “absolute hell.” If you’re in the early stages, you need to brace yourself for this reality. Some agents fail because they simply aren’t putting in the necessary effort. Others fail because they get distracted by the success they’ve already achieved, buying luxury items like a Rolex instead of reinvesting in their business. But for those who are willing to stay focused and put in the work, the rewards are enormous.

If you can make it through those first five years, your wildest dreams could become a reality. Whether it’s financial freedom, a better life for your family, or the ability to give back to your community, the potential is there. But it won’t happen if you quit now. Give yourself five years, and if at the end of that time you’re still unhappy, then it might be time to consider moving on. But if you quit too early, you’ll never know what could have been.

How to Recruit 15,000 Insurance Agents in 12 Years

For those wondering how to grow a business to an extraordinary level, the key lies in building a system. Recruiting and training 15,000 agents over a 12-year period, as some of the industry’s top leaders have done, isn’t about luck or chance. It’s about developing a replicable and scalable system that can function without you micromanaging every detail.

Early in his career, Patrick Bet-David, an entrepreneur and motivational speaker, learned a crucial lesson while working at Morgan Stanley. A top earner in the company revealed to him that real success in the insurance and financial industries doesn’t come from just learning how to sell—it comes from learning how to recruit and develop other agents. Building a team is the secret to sustained success.

A system is what allows you to train others to do what you do without constantly needing your supervision. Whether your system is focused on lead generation, marketing through social media, or building a strong referral network, the key is having a clear, defined process that others can follow. If you don’t have a system, scaling your business is nearly impossible. But if you do, the sky’s the limit.

What Does It Mean to Be Part of the 8%?

Being part of the 8% who make it in the insurance industry means you’re willing to do what others aren’t. It means you’re the person who stays late on a Friday to make a few more calls, or the one who pushes themselves to book one more appointment while everyone else is winding down. It’s about discipline, persistence, and being willing to outwork the competition.

A great example of this is the Saturday night story. When most young professionals would be hitting the clubs or relaxing, Patrick Bet-David and a few of his colleagues stayed late at the office, making extra calls. They set a goal to make 40 calls before they left for the night. After reaching that goal, Patrick encouraged them to push further and make 10 more calls. One by one, his colleagues dropped out, but those who stuck around saw the rewards. That’s the mindset of the 8%—the willingness to go the extra mile, to push beyond what’s comfortable.

Conclusion: Push Through the Pain

For anyone struggling in sales or considering quitting, the message is simple: don’t quit too soon. The struggles you’re facing now are temporary, but the success you could achieve is limitless. Yes, it’s tough. Yes, it’s exhausting. But those who make it through these difficult times are the ones who find success on the other side.

So before you decide to walk away, commit to giving it everything you’ve got for a set period of time. Build a system that can work for you, and surround yourself with people who push you to be better. You might just find that your wildest dreams are closer than you think.

FAQs

- Why do 92% of insurance agents quit?

Many insurance agents quit because the early years can be very challenging, with rejection, slow progress, and financial strain. Some fail due to a lack of consistent effort, while others get distracted by short-term success or don’t build a sustainable business system. - How long should I stay in the insurance industry before considering quitting?

Experts recommend staying committed for at least five years. The first few years are often the hardest, but those who stick it out can experience significant success. - What is the key to becoming part of the 8% of successful Insurance Agents?

The key is perseverance, discipline, and building a scalable system. Successful Insurance Agents are willing to outwork their competition, stay focused, and continuously improve their approach to sales and recruitment. - How can I push through tough times as an insurance agent?

Stay patient, build a support system, and commit to personal growth. Surround yourself with people who encourage you to be better, and maintain a clear, structured business plan to keep progressing even during difficult times. - What should I do if I feel burnt out in the insurance business?

Before deciding to quit, give yourself a set period, like six months or a year, to fully commit and reassess your strategy. Sometimes a change in approach, such as improving your business systems or focusing on a niche market, can reinvigorate your passion for the industry. - How can I recruit more agents and grow my insurance business?

Building a scalable system is key. Focus on creating processes for lead generation, training, and support that can be easily replicated by new agents. Developing others and teaching them to succeed is crucial for long-term growth.

- Why do 92% of insurance agents quit?

5 Essential Reasons Why You Needs Business Insurance

Running a business is no small feat, and while success is the ultimate goal, there are always risks involved. One essential way to protect your business from unforeseen circumstances is through insurance. Whether you operate a small startup or a large corporation, business insurance can provide the safety net needed to keep your operations afloat when things go wrong.

What is Commercial Insurance?

Commercial insurance, also known as business insurance, is a type of coverage designed to protect businesses from financial losses due to a wide range of risks. These risks may include property damage, theft, employee injuries, and lawsuits. Business insurance can be customized based on the specific needs of your company, whether you run a retail shop, a restaurant, or a tech startup.

Reason Explanation Example 1. Legal Protection Covers legal fees and damages from lawsuits. A marketing firm is sued, insurance covers legal costs. 2. Property Damage Coverage Protects physical assets from damage or loss. A fire damages inventory; insurance helps replace goods. 3. Business Continuity Covers income loss during disruptions to maintain operations. Insurance covers bills during the COVID-19 pandemic. 4. Employee Protection Covers medical costs and wages for injured employees. Worker injured on-site; insurance covers medical expenses. 5. Builds Credibility Enhances trust with clients, partners, and investors. Proof of insurance helps secure a business contract. an overview For example, in places like New York City, where the business landscape is dynamic and competitive, having business insurance is crucial. With high property values, strict regulations, and an evolving economy, the risks are often higher. Business insurance in NYC is not only a safeguard against potential liabilities but also a smart investment to secure the future of your venture.

So let’s explore the 5 essential reasons why your business needs insurance.

Protection Against Legal Liabilities

One of the most compelling reasons to have business insurance is to shield your company from legal claims and lawsuits. In today’s litigious society, businesses can be sued for a variety of reasons, including negligence, product defects, or contractual disputes. Legal costs, settlements, or damages can run into thousands—or even millions—of dollars.

Example: Imagine you run a marketing firm, and a client claims that your services caused financial losses for their business. Without professional liability insurance, you could be on the hook for legal fees and damages. However, with the right insurance policy, your legal expenses and any settlement costs may be covered.

Coverage for Property Damage

Another critical reason to invest in commercial insurance is to safeguard your business property. Whether it’s a natural disaster, fire, theft, or vandalism, property damage can result in significant financial loss. If your business relies on physical assets like office space, inventory, or equipment, the right insurance coverage will help you recover quickly.

Example: Consider a retail business in NYC. A fire breaks out in the building, damaging your inventory and equipment. With business property insurance, you can replace the damaged goods and repair your property without a massive financial hit.

Ensuring Business Continuity

Unexpected events, like a natural disaster or a pandemic, can disrupt your business operations, resulting in lost revenue. Business interruption insurance can help cover the loss of income during the time your business is unable to operate. It ensures that you can continue to pay bills, cover payroll, and meet other financial obligations while you work on getting back on your feet.

Example: During the COVID-19 pandemic, many businesses experienced a temporary halt in operations. Those with business interruption insurance could still meet their financial commitments and recover faster once restrictions were lifted.

Safeguarding Employee Welfare

Employees are the backbone of any business, and ensuring their welfare is crucial to maintaining productivity and loyalty. Worker’s compensation insurance is often a legal requirement in many places, but beyond compliance, it protects your business by covering medical expenses and lost wages if an employee gets injured on the job.

Example: In an NYC construction company, an employee might get injured while working on a project. Without worker’s compensation insurance, the company could be liable for medical bills and potentially face a lawsuit. With this insurance, however, the employee’s medical expenses are covered, and the business avoids potential legal trouble.

Building Credibility and Trust

Having the right insurance doesn’t just protect you from financial losses—it also builds credibility with clients, customers, and investors. Many clients and partners require proof of insurance before doing business with you because it signals that you’re a responsible and reliable company. Having insurance can give your business a competitive edge in securing contracts or partnerships.

Example: A potential client looking to partner with your digital marketing agency in NYC may request proof of professional liability insurance. Providing this documentation not only reassures them but could also be the deciding factor in winning the contract.

Conclusion

In a city like NYC, where competition is fierce and risks are high, having business insurance is more than just a legal requirement—it’s a smart business decision. Whether it’s protecting against lawsuits, property damage, or ensuring the safety of your employees, the right coverage provides peace of mind and financial security.

Don’t wait for a crisis to strike. Evaluate your business’s risks and invest in commercial insurance that fits your needs. After all, a small investment today could save you from enormous financial losses in the future.